APPEAL MECHANISM UNDER GST

‘Any person aggrieved by any decision or order passed under this Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act by an adjudicating authority may appeal to such Appellate Authority as may be prescribed within three months from the date on which the said decision or order is communicated to such person.’

-Section 107(1), The Goods and Services Act, 2017

‘The Appellate Authority may, if he is satisfied that the appellant was prevented by sufficient cause from presenting the appeal within the aforesaid period of three months or six months, as the case may be, allow it to be presented within a further period of one month.’

-Section 107(4), The Goods and Services Act, 2017

No appeal shall be filed under sub-section (1), unless the appellant has paid—

- in full, such part of the amount of tax, interest, fine, fee and penalty arising from the impugned order, as is admitted by him; and

- a sum equal to ten per cent. of the remaining amount of tax in dispute arising from the said order, in relation to which the appeal has been filed.

-Section 107(6), The Goods and Services Act, 2017

★ What do you mean by an appeal?

Any legal appeal is an attempt to have the judgement of a lower court reconsidered in front of a higher court. When there are any legal difficulties or disputes, appeals are made. Under GST act, any person aggrieved with the order passed by an adjudicating authority can file an appeal in GST before the First Appellate Authority. Adjudicating Authority is the authority which passes an order or decision against which we appeal.

★ Who can file an appeal in GST to the Appellate Authority?

Any taxpayer or an unregistered person aggrieved by any decision or order passed against him by an adjudicating authority, may appeal to the Appellate Authority, within three months from the date on which the said decision or order is communicated to such person shall file appeal in Form GST APL-01, along with relevant documents and prescribed fees. However, fees won’t be charged in cases where an officer or the Commissioner of GST is appealing.

★ Who cannot file an appeal under GST?

Appealable orders are prescribed under Order 43, R.I. However, appeals cannot be filed based on any order enlisted in clause (a) and from any order passed in appeal under section 100.

★ What is the time limit for filing an appeal in GST?

The appeal needs to be filed within three months from the date of communication of order by the adjudicating authority.

However, under the rule of condonation appeal filing delays, a maximum of one further month is permitted, and that is only after providing a valid justification for the delay and supporting documentation.

★ When can the appeal NOT be filed?

The following decisions made by a GST officer cannot be appealed:

- Order to transfer the proceedings from one officer to another officer;

- Order to seize or retain books of account and other documents;

- Order sanctioning prosecution under the Act; or

- Order allowing payment of tax and other amounts in instalments.

★ What are Appealable orders?

Listed below are the orders against which the aggrieved person can file an appeal:

- Enforcement Order

- Assessment or Demand Order

- Registration Order

- Refund Order

- Assessment Non-Demand Order

- LUT Order.

★ Important points to be noted before drafting grounds of GST Appeal

Before drafting the grounds of appeal, one must carry out an in-depth study of all the documents including – the GST Returns, copies of communications received from the proper officer timely, copies of SCN (show cause notice), replies filed in response to the SCN, copies of proceedings/orders or decision passed by the adjudicating authority, copy of the appellate order. In order to prepare for drafting grounds of a GST appeal, having the documentation in place is extremely important.

Grounds of appeal in GST

It represents the issues which show the nature of the dispute between the assessee and the revenue. A ground of appeal is in the nature of a claim thus, it is distinguished from arguments because arguments are made in support of the claim. There may be several arguments in support of a claim and all the arguments cannot form the ground of appeal.

★ What are the procedures of filing appeals?

If you are aggrieved by an order of an Assessing Officer (AO), you can file an appeal against the same before the Commissioner of Income Tax (Appeals) by submitting duly filled Form 35 online on the E filing portal. The provisional acknowledgement will be granted as soon as the appeal is submitted. However, only after manually submitting Form GST APL-01, a copy of the challenged order, and a declaration of the facts and grounds for the appeal within 7 days of the receipt of the provisional acknowledgement, will the final acknowledgement that has the appeal number, be issued.

Step1: File the Notice of Appeal.

Step2: Pay the filing fee.

Step3: Determine if/when additional information must be provided to the appeals court as part of opening the case

Step4: Order the trail transcripts.

★ Should every appeal be made to both CGST & SGST authorities??

No. As per the GST Act, CGST & SGST/UTGST officers are both empowered to pass orders. As per the Act, an order passed under CGST will also be deemed to apply to SGST. However, if an officer under CGST has passed an order, any appeal/review/ revision/rectification against the order will lie only with the officers of CGST. Similarly, for SGST, for any order passed by the SGST officer the appeal /review /revision / rectification will lie with the proper officer of SGST only.

★ Can an authorised representative appear in court??

Yes. Any person required to appear before a GST Officer/First Appellate Authority/Appellate Tribunal can assign an authorized representative, subject to certain conditions as per law, to appear on his behalf, unless he is required by the Act to appear personally.

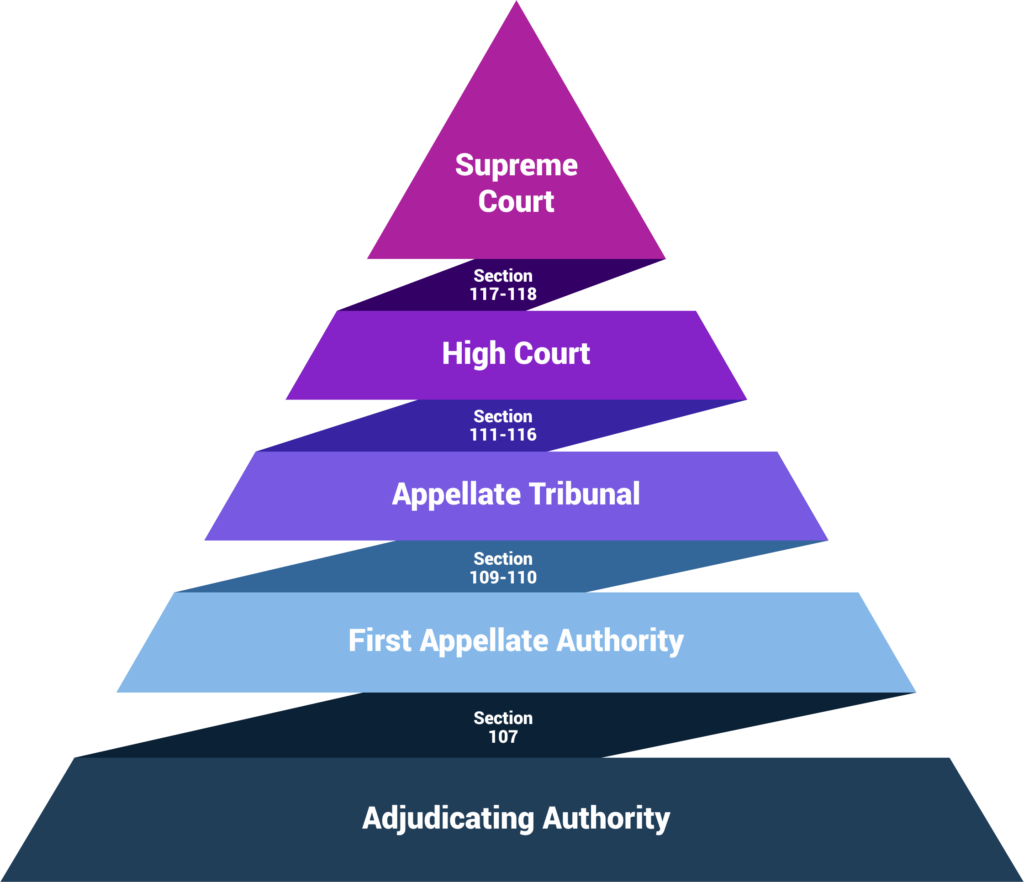

★ Levels of Appeals??

Level 1 – If the order is passed by Adjudicating Authority, then you can appeal to First Appellate Authority under section 107 of the GST act.

Level 2 – If the order is passed by First Appellate Authority then you can appeal to the Appellate Tribunal under section 109, 110 of the GST act.

Level 3 – If the order is passed by Appellate Tribunal then you can appeal to High Court under sections 111 – 116 of the GST act.

Level 4 – If the order is passed by High Court then you can appeal to Supreme Court under sections 117-118 of the GST act.

Appellate Authority

A person who is aggrieved by a decision or order passed against him by an adjudicating authority, can file an appeal to the Appellate Authority. It has to follow the principles of natural justice such as: Hearing the appellant, allowing reasonable adjournments, Permitting additional grounds, etc. It can also make such further inquiry as may be necessary. On conclusion of the appeal process, it will pass his order (Order-in-Appeal) which may confirm, modify the decision or order appealed against but shall not refer the case back to the authority that passed the said decision or order.

Appeals before Tribunal

The Tribunal is the second level of appeal, where appeals can be filed against the orders- in-appeal passed by the Appellate Authority or order in revision passed by revisional authority, by any person aggrieved by such an order-in-appeal/Order in revision.

The law envisages constitution of a two-tier Tribunal i.e., National Bench/Regional Benches and the State Bench/ Area Benches. An appeal from the decision of the National Bench will lie directly to the Supreme Court and an appeal from the decision of the State Bench will lie to the jurisdictional High Court on substantial questions of law.

The Tribunal after hearing both sides may pass such orders thereon as it thinks fit, confirming, modifying or annulling the decision or order appealed against or may refer the case back to the Appellate Authority or to the revisional authority, or to the original adjudicating authority, with such directions as it may think fit, for a fresh adjudication or decision, as the case may be, after taking additional evidence, if necessary.

Appeal to the High Court

The law provides that either side (department or party) if aggrieved by any order passed by the State Bench or Area Bench of the Tribunal may file an appeal to the High Court and the High Court may admit such appeal if it is satisfied that the case involves a substantial question of law. It is to be noted that on facts, the tribunal is the final authority. Appeals to the High Court are to be filed within 180 days, but it has the power to condone delay on being satisfied of sufficient cause for the same.

Appeal to the Supreme Court

The law provides for appeals to the Supreme Court from any judgment or order passed by the High Court, in any case which, on its own motion or on an oral application made by or on behalf of the party aggrieved, immediately after passing of the judgment or order, the High Court certifies to be a fit one for appeal to the Supreme Court. A (direct) appeal shall also lie to the Supreme Court from any orders passed by the National/Regional Bench of the Tribunal. It may be noted that the National/Regional Bench of the Tribunal has jurisdiction to entertain appeal if the dispute or one of the issues in dispute involves place of supply.

Mechanism of Revision by the Commissioner

The GST Act also provides for the mechanism of revision, by the Revisional Authority, of the orders passed by his subordinate officers. If the Revisional Authority on examination of the case records is of the view that the decision or order passed by any officer subordinate to him is erroneous in so far as it is prejudicial to the interest of the revenue, and is illegal or improper or has not taken into account material facts, he may, if necessary, stay the operation of such decision or order for such period as he deems fit and after giving the person concerned an opportunity of being heard and after making such further inquiry as may be necessary, pass such order, as he thinks just and proper, including enhancing or modifying or annulling the said decision or order. Subject to the condition that non-appealable orders and decisions cannot be revised.

Appeals by the Department (CGST/SGST) before the AA/Tribunal

At times, the Department itself is not in agreement with the decision or order passed by the (initial) adjudicating authority or the appellate authority. The GST Law provides that in such cases, the Department can file what is commonly known as a “review application/appeal”. The GST Law gives powers to the Commissioner to review any order passed by his subordinates acting either as an adjudicating authority, or the appellate authority or revisional authority. If the Commissioner is of the view that any order passed by such authorities are not legal and proper, he can direct any officer subordinate to him to apply to the competent authority. The review of the order and the consequent filing of appeal by the subordinate has to be done within a period of six months from the date of communication of the order. The resultant review application is required to be dealt with by the AA or the Tribunal as if it were an appeal made against the decision or order of the adjudicating authority and the statutory provisions relating to appeals shall, so far as may be, apply to such application.